on the sill

watching costumed kids

the black cat

on the sill

watching costumed kids

the black cat

fall twilight ~

muertoween lights glow

on the maple tree

It only struck me now that this level is, to a large extent, “Animal Antics” done right: the 3 most interesting animal buddies in this game ( & also the new animal buddies 1st introduced in this game ) challenged in a race upward gainst the rising toxic green lava, or whate’er it’s s’posed to be. This is also a much better version o’ “Slime Climb”, as the toxic lava is consistently rising @ the same pace so that gains you make @ certain setpieces give you mo’ time in later setpieces, rather than having the water jump to near where you are @ e’ery so event point, like in “Slime Climb”.

fall holiday ~

the turning o’ dusty

yellow leaves

ripening

stone wall leaves & moss ~

fall twilight

Thanks to its focus on platforming & barrel cannons, this level is much funner than it is to write ’bout. Howe’er, unlike levels like “Hot-Head Hop”, this level’s platforming is a bit mo’ intricate — as well as harder. You have subtle touches like the transition from the upward-shooting barrels under the K to the small platform with the Klomps, where you want to land on 1 o’ the Klomps & bounce onto the head o’ the other 1, but are @ a high risk o’ landing ’tween them & getting hit.

scattered leaves

black shadows &

orange holes

fall sunset ~

standing ’lone on the rail

portapotty

“Topsail Trouble” feels like 2 different levels joined @ the midpoint, with the 1st half acting essentially an introduction to the animal buddy Rattly & the 2nd half basically being a harder version o’ “Mainbrace Mayhem”, with its nets & ropes littered with far mo’ enemies — & with a greater focus on the mo’ dangerous Zingers, whom you can’t jump on, than Klingers — in much tighter clumps, leaving much less room to maneuver thru them. This 2nd half would’ve probably worked better if it didn’t come only 3 levels afterward — both in terms o’ providing a better reason for this leap in difficulty & for better variety. Then ’gain, maybe a slight rise in difficulty is a good way to end a world, e’en the 1st. I don’t think as a kid I e’er found this level that challenging for where it is — not on the same level as, say, “Red-Hot Ride” or e’en the end o’ DKC1’s 1st world, “Barrel Cannon Canyon”. Jumping & weaving ’tween tightly-packed, fast-moving Zingers is certainly funner than waiting for the slow-moving Klingers to get out o’ your way. Part o’ me feels like this level would’ve worked better if they a’least mixed the disparate elements, but I can see how it would’ve been awkward to keep getting & losing Rattly. Such a stark split would’ve worked better as a rare contrast if it weren’t done on a few other levels, such as “Rambi Rumble” — & e’en that was mo’ memorable. Then ’gain, this level is still somehow mo’ coherent than “Mainbrace Mayhem”.

Normally I don’t like to dive deep into the ugliness o’ politics during the best month o’ the year, October, a time best spent on autumn weather & horror, but recently there’s been an interesting development in arguably 1 o’ the most spine-tingling o’ topics — the current state o’ the economy. ( ¡Boo! ¡Whack Family-Circus-ass joke! ).

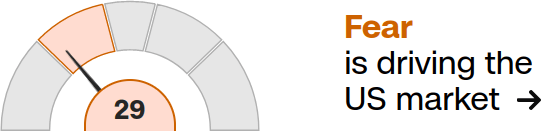

CNN, desperate to get their 15 seconds o’ fame for clicks & hits in the same way Jessica Simpson did decades ago or the modern celebrity moron, the average Republican, does today — saying something incredibly stupid & getting e’eryone to make fun o’ them — cooked up something fun for us tonight:

“Here’s why the shockingly good jobs report is going to cost you”.

“You” is the word that deserves scrutiny. A common misconception that economists & people who pretend to know anything ’bout the economy ( ¡like me! ) imply is that there is some magical economy that gives e’eryone what they want. For instance, I would question the idea that someone who would otherwise be unemployed not being unemployed endured any cost by having the means to keep themselves from starvation. But people who have plenty o’ money in the stock market are costing a lot by having that stock ticker be orange.

Here’s why: Inflation is still biting. Prices continue to rise faster than anyone would like. Although annual price increases aren’t in wild-runaway mode like they were when inflation was above 9% last year, inflation is still above 3%, which is unhealthy for the economy, according to the Federal Reserve and a number of economists. (The Fed believes 2% inflation is ideal over the long haul.)

What I want to emphasize most with this paragraph is that it feels like ’twas written by an elementary school student, with its short, choppy sentences that assert simplistic claims that don’t fit the true complexity o’ modern economics. Saying that “prices continue to rise faster than anyone would like” is as meaningful as saying “there are mo’ deaths in the world than anyone would like”: any inflation greater than 0 is going to rise faster than anyone would like — that doesn’t mean it warrants comment.

The funny thing is that e’en someone who knows nothing but economics but takes CNN @ their word, but can compare #s, can see the mismatch o’ CNN’s tone & what the #s tell: inflation went from a whopping 9% down to “above 3%” ( I had to go to a better news source, NBC News, to find the actual # 3.7% ), which is the best way to try to imply a # >= to 4% without outright lying, which is a whopping 1.7% greater than what the Federal Reserve — here called by their rap name, “The Fed”, ’cause CNN is too down with the sickness to use their stuffy full name that might go o’er the heads o’ the teenagers they’re desperately trying & failing to get to read them — considers “ideal”. I don’t know ’bout you, but inflation going down from such a historical high — 7% greater than “ideal” — to just ’bout a % point or 2 ’bove the “ideal” without hurting the high employment level or rising wages sounds miraculous to me. In fact, it sounds better than the usual pattern since the 70s — coincidentally, when we started taking the monetarist witchcraft “the Fed” tries & laughably fails with time & ’gain — o’ stagnating wages that can’t keep up with e’en the small “ideal” inflation.

Economists had expected the data to show a 3.6% overall increase in inflation compared to a year ago. Annual inflation has now ticked up two months in a row after 12 consecutive months of decline.

These 2 data points — 1 o’ which is just empty tarot-card reading from economists, who tend to acknowledge that economic science is not developed ’nough ( & probably ne’er will be due to the unpredictability o’ humanity & the “observer effect” o’ economists’ predictions being loudly announced to e’eryone thru the media tampering with results ) — don’t connect, since they use completely different time units, the latter o’ which is vague. ¿Who cares if annual inflation has “ticked up” some vague amount 2 times in a row? ¿Is the amount “ticked up” a lot or a li’l? ¿& how would it be better if ’twere 2 months broken off by other months. Anyone who understands basic math knows that consecutive months vs. split-off months wouldn’t affect the sum — which is what the former data point references. ¿Does the 2nd data point add up to the expected o’erall 3.6% increase? We don’t know, ’cause CNN for some reason is trying to give us a fun Halloween mystery by not giving us specific #s. Luckily, as mentioned earlier, a better news source was less interested in Encyclopedia Brown puzzles & just said 3.7%, which, to be fair to economists, is remarkably close to expectations. We should give them all that stuffed carnival panda as a sweet reward.

When you see gas prices at $3.75 on average (and above $4 in plenty of places across the country)…

Hold on — gas prices are that low. $5 gas prices were normal a decade ago. I’ve ne’er in my life seen gas lower than $3.75, certainly not any time in the 21st century. I would expect it to be $8 a gallon by this point — specially since what with gas production literally destroying the planet, I would expect there to be, you know, tax penalties to keep people from buying this shit & helping to destroy the planet.

…and a restart to student loan payments for millions of Americans, that’s why a majority of Americans say President Joe Biden’s policies have made economic conditions worse.

Ah, yes, Joe Biden’s policy o’ forcing students to repay their loans, I remember that. I also remember just 2 days ago CNN themselves mentioning, let’s see, “Biden cancels another $9 billion in student loan debt days after payments restart”. Clearly that’s just a devious plot by Dark Brando the Grando Wizando to lure students into a false sense o’ security before he strikes with surprise loans later. This is what the test broadcast last Wednesday was — those o’ us who believe we had our student loans paid off have now been infected with “swine student loans”, which will be sucked out o’ us thru microchips soldered by Bill Gates himself & into Biden’s secret Marxist pedophile fund for erecting statues o’ Karlos Marukasu e’erywhere — for e’eryone knows that Marx is so sexy that any child who sees a statue o’ him will themselves become erect — ¡e’en those without penises, that red devil is so magical!

That’s CNN’s opinion: very sloppily argued by throwing out a bunch o’ data that doesn’t actually serve their intended conclusion, & some o’ it just straight lies, & saying “that’s why” — the best way to make an argument, I always learned in the ol’ debate class. My opinion, which I would say is backed by centuries o’ gleaned wisdom from experts, is that the reason the average American thinks these things is that they’re uninformed, uneducated morons who jump to “bad economy president’s fault” ’cause that’s the kind o’ best guess you can make when you’re utterly bereft o’ any mental tools for economic analysis. Certainly the legislature ( “¿the ‘ley-jeez-what’?” ) & their barely managing to agree to hold off yet ’nother hilarious government shutdown in the richest country in the world for ’bout a month or so as the final magnum opus o’ politician nobody likes Kevin McCarthy just before he got his face eaten by his fellow leopards & shitposting Democrats had nothing to do with the US’s economy… somehow not being in as bad shape as Europe ( the US is a perfect specimen o’ “failing upward” ). Nonetheless, Americans, ne’er ones to settle for less, have higher expectations & are still debating ’mongst themselves whether or not they might give ’nother chance to the candidate who attempted a dictatorial insurrection, has plans for his next term including indictments gainst all his political enemies & setting up a “gulag” for legal immigrants, & who, those with memory ( not Americans ) remember was the one who exacerbated this whole inflation problem in the 1st place by delaying COVID treatment o’ the nation with his hilarious shitposting on Twitter X.

As prices continue to grow, paychecks are barely keeping pace. They grew 4.2% over the past year, the slowest pace of growth since the early days of the pandemic in 2020.

’Gain, just do the fucking math: that’s higher than the earlier-mentioned inflation #. Wages being higher than inflation is pretty good, considering how stagnant wages have been for the past 4 decades.

Also, I can’t imagine “the Fed” are too disappointed by these #s, as the Federal Reserve’s policy for trying to bring down inflation was trying to bring down wages by, get this, inducing unemployment. ( The fact that e’ery “workable” form o’ capitalism that has e’er existed in the real world involves the government using their vast controls o’ the economy to induce or reduce unemployment is why anyone with e’en the most basic understanding o’ economics finds the ol’ “pull yourself by your bootstraps” idea o’ capitalism to be a laughable fairy tale on the same level as “pray to Jesus for economic success” ).

So a robust job market won’t make most people feel like the economy is strong.

Well, yeah: ¿who wants to go back to work after year long forced vacations due to COVID? I wanna stay home & play Animal Crossing all day.

The Fed is working to slow the economy by hiking interest rates — the only tool it has to fight inflation.

Ah, so you are aware o’ this fact, & thus the previous complaint ’bout wages not being high ’nough completely contradicts this point.

It’s too bad there are no other parts o’ the government, like the legislature, who could pass, like, fiscal policy to help lower-class Americans make up for the greater burden o’ high inflation while waiting for inflation to keep decreasing as manufacturing continues to spin back to life. Nah, they would rather focus their efforts on conspiracy theories ’bout the son o’ the president & his possessed laptop o’ the occult, like any serious government should.

A still-robust job market — see the 336,000 jobs added last month — means the central bank could continue to increase rates without fear of sending the economy into a recession.

“The economy is roaring with the demand for workers literally through the roof,” said Chris Rupkey, chief economist at FwdBonds, in a note to clients on Friday. “Interest rates are likely to remain higher for longer to ensure the inflation fire is out.”

Educate me, ’gain, on what the “cost” is o’ the Federal Reserve having mo’ room to fight inflation without the fear o’ inducing a recession. I guess if you want recession or are ’fraid o’ inflation going too far down that’s a problem. Or maybe not having a ’scuse for keeping unemployment up is the real problem.

JPMorgan Chase CEO Jamie Dimon repeated in recent weeks his fear that rates could go to 7%. Government bond yields are rising to multi-year highs in expectation of rates going up — and loans pinned to those yields, including mortgages and credit card rates — are set to go up, too.

Ah, average American, CEO o’ giant-ass monopolistic bank, will educate me. It sounds to me like this is a big ol’ problem for creditors, — also known as parasitical leeches — not for people who actually work for their money. I guess when CNN said it’ll cost “me”, they meant it’ll cost my bank CEO.

Credit card rates are well north of 20% on average, a two-decade high. People who carry a balance month to month are paying a hefty premium in interest, which means it will take even longer to pay off what they owe.

O, ne’er mind: e’en the leeches are still doing fine. The only people who seem to be doing worse are people who have debts, — people who have been being screwed for eternity, already — & not e’en by all that much, since according to Nerd Wallet, the average rate was 16.44% in 2021. ’Course, CNN doesn’t offer this # as a comparison themselves, since actually informing people is much less valuable than throwing round #s bereft o’ context & using super scary language is much better for rage clicks.

Meanwhile, US mortgage rates climbed to 7.49% this week, up from 6.66% a year ago and the highest level in more than two decades. That has kept the housing market in neutral [ emphasis mine ], keeping the key to middle-class wealth growth out of reach for so many would-be homebuyers.

Man, you’re really convincing me of our dire situation with this neutral housing market. ¿When will someone finally impeach Biden already?

We should never cheer a bad job market. But a job market that has remained this healthy for this long really isn’t excellent news for average Americans struggling to pay their bills. Meanwhile, we remain in a “good news is bad news” conundrum that makes most people feel like the US economy is in a bad spot.

The best part o’ this self-contradicting incoherent jumble o’ a paragraph trying pathetically to work as propaganda is how self-inflicting it is: @ a time when young people are becoming mo’ & mo’ jaded with capitalism & mo’ supportive toward socialism, I can’t imagine that telling people “an economy good for working class people is actually bad” & calling for mo’ unemployment after Millennials withstood a whole decade o’ being shamed for their high unemployment works as a good advertisement for capitalism, nor can I imagine the average worker having a positive opinion o’ self-proclaimed economic experts whose only solution is to throw 2% o’ potential employees into destitution. & people wonder why homelessness is such a problem when it is considered good economic policy to try & force people to be jobless. Bums who beg for money on the streets told to “get a job” should quip back, “¡but then I’d be causing you inflation & costing you e’en mo’!”. After all, it’ll be much harder for you to buy food if you keep having that job that allows you to have money to buy food @ all. It’s almost as if capitalism is an unreasonable “damned if you do, damned if you don’t” economic system where people who aren’t politically powerful have no chance to succeed no matter what they do & offers absolutely no solution to homelessness or poverty & finding some alternative to capitalism is the only solution. That’s the message CNN delivers, anyway. I doubt they intended to — but then, given how incoherent & inane this article was, I don’t think anyone @ CNN are smart ’nough to understand what they’re trying to say.

As a fun bonus, the New York Times tried the same thing, titling 1 o’ their articles “U.S. Job Growth Surges Past Expectations in Troubling News for the Fed”, which sounds like the title o’ a Superman comic. Like what happens a lot in the modern world o’ social media where ol’, out-o’-touch, moderate conservative New York Times editors have their anti-lower-class biases pointed out & ridiculed by the vicious liberal masses, — who nonetheless, are their target audience, & must be fed accordingly, as papa market demands o’ them — they changed the title like Stalin erased Trotsky out o’ those photos. This is the real liberal fascism that, um… that 1 generic conservative whose name I don’t want to look up wrote ’bout.